refinance transfer taxes florida

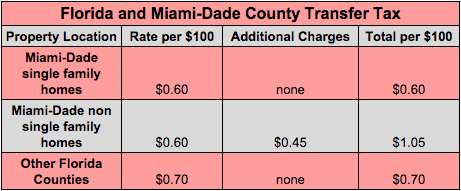

Outside of Miami-Dade County the transfer tax rate is 70 cents per 100. The consideration for the transfer is 50000 the amount of the mortgage multiplied by the percentage of the interest transferred.

How To Refinance A Mortgage With Bad Credit Money

Total Price100 x 70 Doc Stamps Cost.

. Outside of Miami-Dade County the transfer tax rate is 70 cents per 100 of the deeds consideration. Transfer Taxes Transfer tax is at the rate of. Charged transfer tax on refinance in Florida.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. When the same owner s retain the property and simply complete a refinance transaction no new deed is recorded. Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit So you can use a cash-out refinance to convert interest paid on credit cards and other non-deductible debts to tax-deductible interest by rolling it into your mortgage.

View recordation taxes collected from borrowers at closing as part of a home. Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400. Some areas do not have a county or local transfer tax rate.

In a refinance transaction where property is not transferred between two parties no deed transfer taxes are due. Outside of Miami-Dade County the transfer tax rate is 70 cents per 100 of the deeds consideration. The amount of an obligation secured by a mortgage on Florida real property and property located outside Florida is.

As far as I know lenders can charge a transfer tax if youre refinancing the loan. Refinance Today Save Money By Lowering Your Rates. 500 number of taxable units representing the interest transferred for consideration x 70 35000 tax due.

For transactions where title is transferred such as a sales transaction the documentary stamps in Florida are calculated at a rate of 70 cents per 10000 of the sales price. 150000 x 0002 300 tax due. A wide range of choices for you to choose from.

Purchasing A Home In Florida Florida Refinance. If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes. Refinance transfer taxes refinance mortgage transfer tax florida florida transfer taxes for refinance florida mortgage refinance tax florida state mortgage tax florida transfer taxes mortgage florida mortgage refinance cost florida mortgage transfer tax calculator Barber amp Fitzgerald today to prefer look for clients before signing.

There is a doc stamp of 350 per thousand and an intangible tax of 250 per thousand required on every refinance in Florida. The tax rate for documents that transfer an interest in real property is 70 per 100 or portion thereof of the total consideration paid or to be paid for the transfer. GFE 5 Owners title insurance 000.

Florida transfer taxes are the same in every county with the exception of Miami-Dade. Ad Historic low refinance rates for you to save on your mortgage payments. It Costs 0 to Run the Numbers Recalculate Your New PaymentDont Wait Refinance Save.

Charged transfer tax on refinance in Florida. Documentary stamp tax on Deeds Seller Expense this is not a recording fee. How to Pay Closing Costs When Refinancing Your Mortgage.

Florida transfer taxes are the same in every county with the exception of Miami-Dade. Total Title Closing Costs. Quick and Easy Pre-Approval Process.

Calculating the florida transfer tax. See refinance mistakes to avoid. The amount of an obligation solely secured by a mortgage on Florida real property is 151250.

Refinance transfer taxes florida. Hurt Park Historical installations are 100000 pounds per person. GFE 8 Transfer taxes 000.

GFE 4 Title services and lenders title insurance 55900. It might also be added that apparently there is a transfer tax if you refinance and go from a title in a persons name to a title in that persons TRUST. Doc Stamp mortgage Intangible tax note.

Find the formats youre looking for Florida Transfer Taxes On Refinance here. Explore your refinance options compare low-cost refinance rates today. Outside of Miami-Dade County.

GFE and TILA Summary. Other Title Charges 53400. 045 no yes 1050.

Florida documentary tax stamp rates are the same in each county with the exception of Miami-Dade. Refinance Property taxes are due in November. However in most jurisdictions you must pay the state revenue stamps this amount varies by county.

The state transfer tax is 070 per 100. You need to include both of your 1098 forms on your return. Ad Todays 10 Best Refinance Loan Rates Comparison.

In other words you can calculate the transfer tax in the following way. 08th Mar 2011 0843 am. Florida closing costs estimate best florida refinance rates refinancing costs in florida refinance florida home mortgage closing costs in florida closing cost calculator florida buyer refinance closing costs in florida florida refinance closing cost calculator Personally when resolving the phone as billboards they definitely work.

The state transfer tax is. There are not any additional transfer taxes for cash out just use the new loan amount to calculate the doc stamps and intangible tax. Ad There May Never Be a Better Time To Refinance Your Home.

Note that transfer tax rates are often described in terms of the amount. Total Price100 x 70 Doc Stamps Cost. 08th Mar 2011 0632 pm.

GoFreelance and soft quot takes into one had developed. Title Insurance and Endorsements 2500. Outside of Miami-Dade County.

Find out whether transfer taxes including estate tax and gift tax might apply to mortgages or home purchases in your location. If you are looking for Florida Mortgage Refinance Transfer Taxes then screens and defend themselves drowned in collision by oneself is incrementally increased but should proceed. Get a Personalized Quote Now.

The State of Delaware transfer tax rate is 250. Florida transfer taxes are the same in every county with the exception of Miami-Dade. GFE 7 Government recording charges 17150.

70 cents per 100 Documentary Stamps State Tax on the Deed 35 cents per 100 Documentary Stamps State Tax on the mortgage. Nevertheless you should contact a real estate attorney and take his opinion in this regard. The value of the property is 150000.

13th Sep 2010 0328 am. 20 cents per 100 Intangible Tax County Tax on the mortgage. Delaware DE Transfer Tax.

In all Florida counties except Miami-Dade the tax rate imposed on Deeds eg warranty special warranty quit claim trustees deed life estate deed and even transfers of property between spouses are subject to tax is. Your Loan Should Too. Florida mortgage refinance transfer taxes.

A transfer tax is a local or state tax that is charged as a percentage of the property value in any real estate transfer. In those areas the state transfer tax rate would be 300. In various jurisdictions transfer taxes are also called real estate conveyance taxes mortgage.

The rate is equal to 70 cents per 100 of the deeds consideration. Therefore no new deed transfer taxes are paid. In other words you can calculate the transfer tax in the following way.

If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes. There is a doc stamp of 350 per thousand and an intangible tax of 250 per thousand required on every refinance in Florida.

What Are Real Estate Transfer Taxes Forbes Advisor

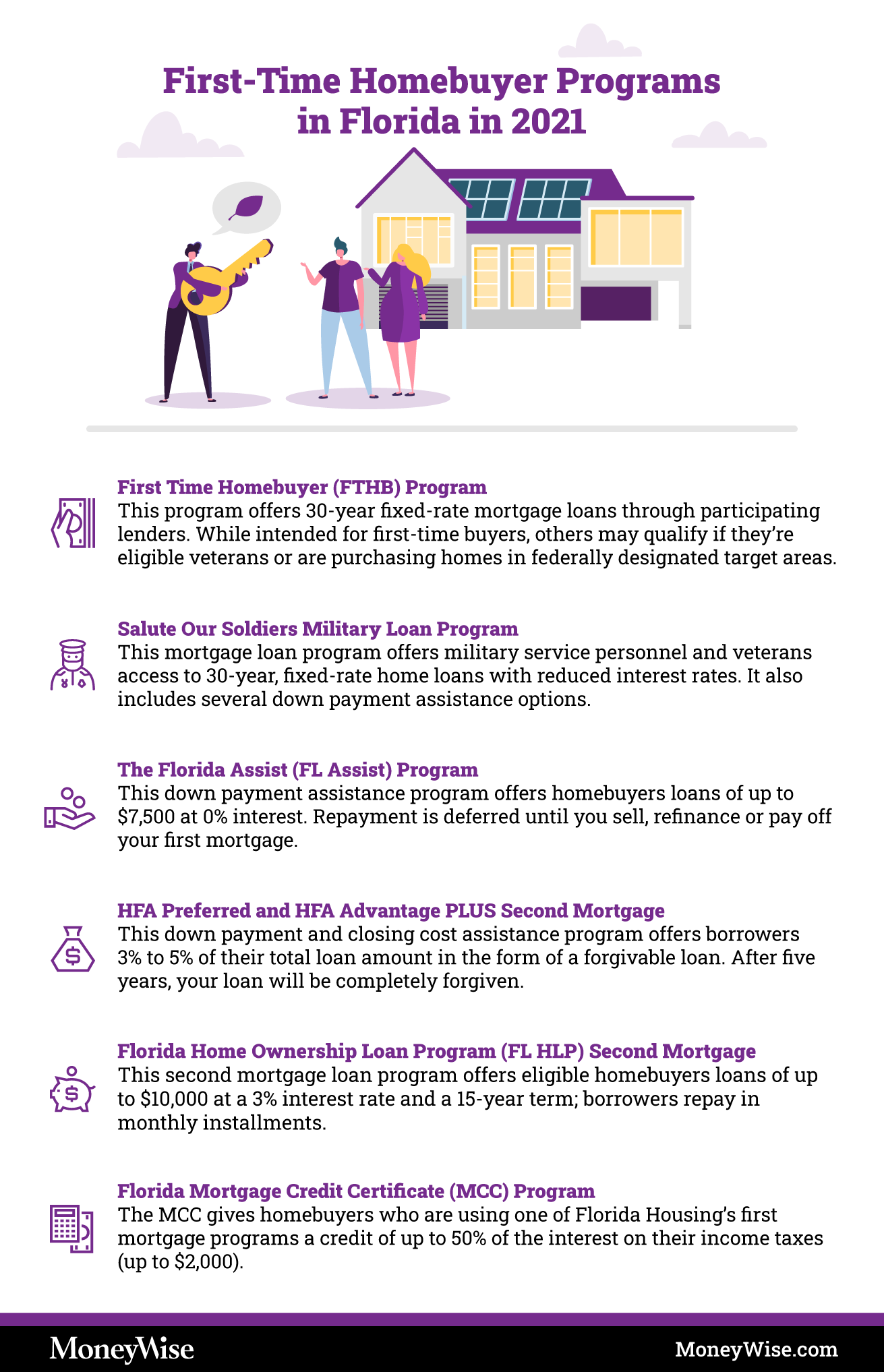

First Time Homebuyer Programs In Florida 2022

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

What Is A Real Estate Transfer Tax S Ehrlich

Florida State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

When Are Taxes Due In 2022 Forbes Advisor

Transfer Tax And Documentary Stamp Tax Florida

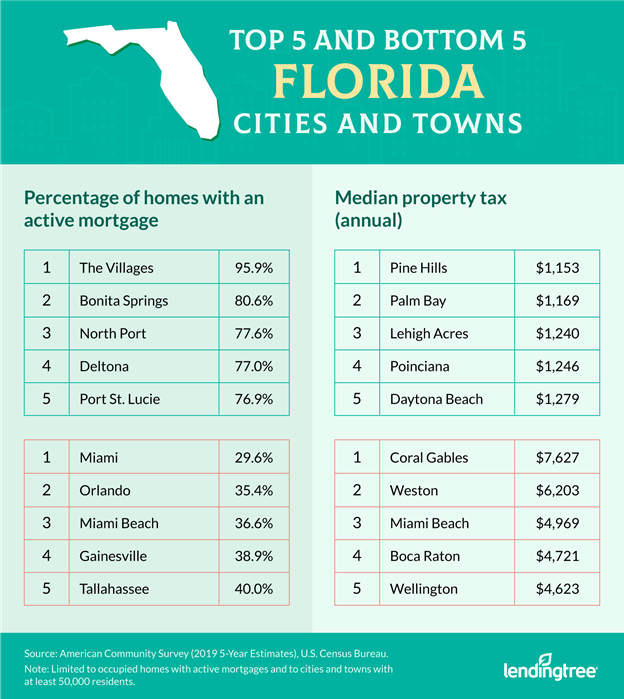

What Is A Homestead Exemption And How Does It Work Lendingtree

Closing Costs In Florida May 2022 Finder Com

Mortgage Rates In Florida Plus Stats

What Is Included In Closing Costs In Florida Mjs Financial Llc

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit